Kathleen and Don are both doctors, married, and 30 years old

How should they invest their money?

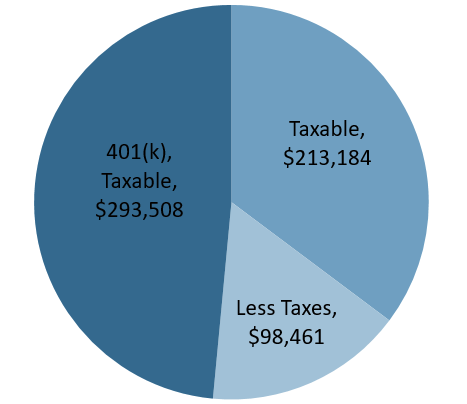

Supplementing their 401(k) with taxable investments

Annual cash flow after taxes $408,231

Supplementing their 401(k) with taxable investments and Life Insurance

Annual cash flow after taxes $514,713

Here are the results for Kathleen and Don

| Taxes | Net Cash Flow | |

|---|---|---|

| 401(k) and Taxable Investments ONLY | $98,461 | $408,231 |

| 401(k), Taxable Investments and Life Insurance | $86,487 | $514,713 |

Death Benefit at age 92 → $364,085*

Added Annual Cash Flow → $106,482

An example is hypothetical and for illustrative purposes.

*Death benefit will decrease over time (e.g. approx. $73,000 at Age 95; $10,000 at Age 100) but invoking the Overloan Protection riders will guarantee the policies will not lapse