News

Holiday Savings Strategies 101: Plan and Execute

The holiday season is the time of year when personal expenses are likely to increase. Whether it may be travel expenses, events, or retail spending. Start preping your holiday savings strategies now. The 2020 holiday shopping season spend is expected to be substantial, but likely less than 2019’s Brick-and-mortar retail and e-commerce spending of $1.007 trillion. Today, holiday shoppers spend less time looking for gifts, but spend more money, especially when shopping online. On average, shoppers in 2019 distributed their holiday spend among the following:

- $596 on experiences

- $511 on gifts

- $389 on non-gifts

Fall Festivities and Socializing- Safely.

Socializing is critical for mental health, and people who associate with others live longer. Research also concludes that isolation can often lead to loneliness, depression, and other health problems. Especially now, during COVID-19, our desire to connect with others is heightened. Before the fall season changes to winter and cold weather arrives, get out and enjoy the season- but do so safely. Here is a list of ideas to safely enjoy fall festivities until we experience brighter days ahead in a post-COVID-19 world:

Head Outside

COVID-19 does not mean you need to confine to your home; you can still enjoy the outdoors’ natural beauty. Just remember to practice social distancing while walking, biking, or while attending outdoor fall events. Remember that even a walk around your neighborhood with a friend is a way to get a little sunshine, exercise, and socially distanced socialization.

Be Neighborly

While a cup of coffee or hot cider indoors with your neighbor or at a cafe may not be an option, have it outside while distancing at least 6-8 feet apart. Bringing cider or coffee and blankets to a local park provides an additional canvas for enjoying time with others.

Attend a Fall Farmer’s Market

Farmer’s markets are one of the fall festivities open in many states. It may require ‘masking up,’ washing hands, moving one direction through the market, and socially distancing. You may be limited in handling the product or other items and required to pay with cards versus cash. Check your local area and experience a pumpkin patch for an added outdoor experience.

Fall Football

If fall sports occur in your community, sit on the sidelines out of the grandstands unless the seating is limiting. While outside, limit your exposure by avoiding contact with others.

While we still do not know everything about COVID-19, the CDC has established guidelines to help reduce the virus’s spread that can be found here. Isolation and socially distancing aren’t going to last forever. While it not yet safe to return to the way our lives were before COVID-19, there are ways to safely socialize in person versus through a screen or phone call.

1334220-0920a

Charlie leverages his extensive background to structure insurance-based plans to protect families and businesses. He is a rare individual who believes the client relationship is the most important aspect of protecting a family’s future. Charlie has been a financial advisor and insurance specialist for over 20 years. In conclusion, contact us today to schedule your first appointment.

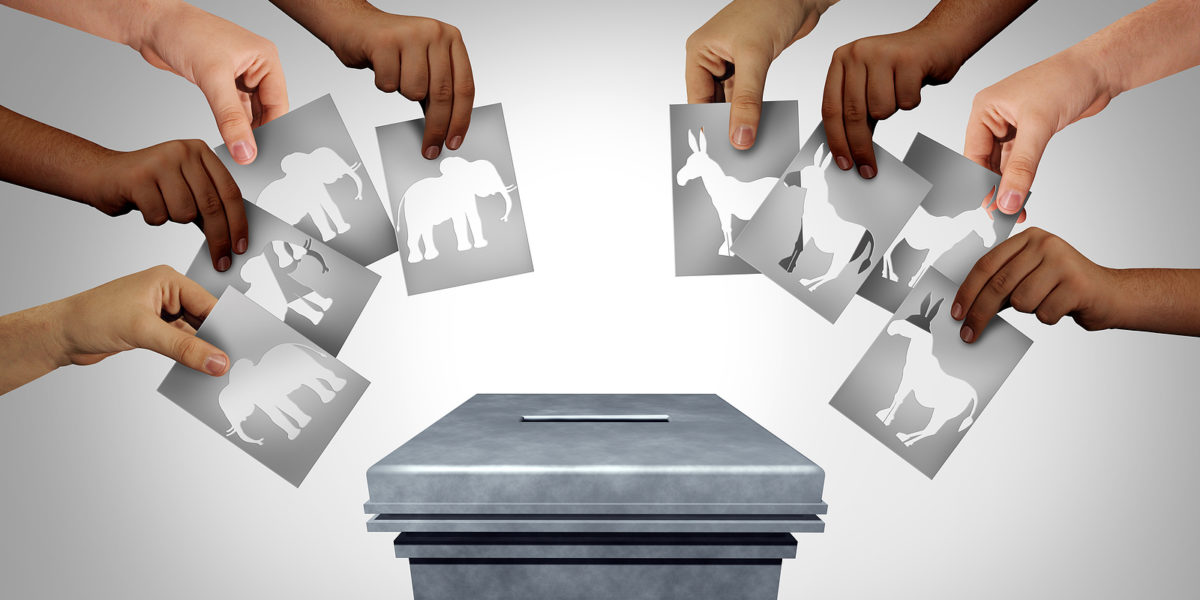

The 2020 Election: Check Your Emotions and Stay Invested

November third is fast approaching, and you may be wondering how the 2020 Presidential election might impact your portfolio. Here is what we know from a historical perspective:

Now is the Time to Schedule Your Fall Financial Review

October is the financial planning month and a great time to meet with your financial professional to ask questions, review policy and portfolio performance, and make decisions that keep you on track with your goals. Regardless of your age, it may be a suitable time for you to schedule a financial review.

Lowering Interest Rates: Good for the Economy and the Markets?

Interest rates can positively or negatively affect the U.S. economy, the stock markets, and your investments. When the Fed changes the Federal Funds Rate (the rate at which banks can borrow money to lend to businesses or you), it creates a ripple effect. In this article we take a look at how lowering the interest rate can impact you.

What Does Wealth Mean to You?

When people think of wealth, they might think of examples in film, such as Veruca Salt from the 1971 classic Charlie & the Chocolate Factory. Little Veruca had everything she wanted in life but desired one of Willy Wonka’s geese that laid golden eggs. When Wonka refused to sell the little girl’s father one of his prized fowls, the girl broke into song about how she wanted everything… and ultimately labeled a “bad egg” and sent down the garbage shoot.

Life Insurance as Unique as You

Your life insurance needs are unique to your situation and can change over your lifetime. For some people, life insurance is to provide assets to raise a young family in the event of early death. Other people may use life insurance to cover their debt to ensure it is taken care of if they die prematurely. In business, life insurance could be a tool to transition ownership when the company sells or to insure a key employee whose death would profoundly affect the business.

Reg BI: What Is It, and Why Should You Care?

On June 30, 2020, Regulation Best Interest, or Reg BI for short, officially went into effect. But what is Reg BI, exactly? Where did it come from, and how does it impact you, the investor? Here’s what to know about the new rule under the Securities and Exchange Commission (SEC).

The CARES Act and RMD: Relief for Investors

YOu The CARES Act (The Coronavirus Aid, Relief, and Economic Security Act) contains the legislation for Required Minimum Distributions (RMD) for those over age 70 ½ and have already started RMD. Under the CARES Act, no RMD is required for individuals or beneficiaries of inherited retirement accounts in 2020 due to COVID-19. How will this help investors?

The Upside of the COVID-19 Pandemic

The COVID-19 pandemic has pulled the rug out from under just about everyone on every continent.

This pandemic has understandably had a dramatic effect on the everyday lives of most people across the globe. With stay-at-home orders to work remote and children distance-learning this past school year and possibly this fall, many cannot wait for 2020 to be over.