Susan, age 40, is a civil engineer

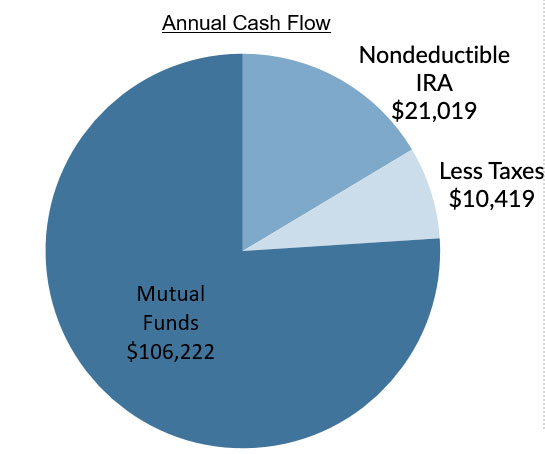

Using only nondeductible IRA and Mutual Funds

Annual cash flow after taxes $150,913

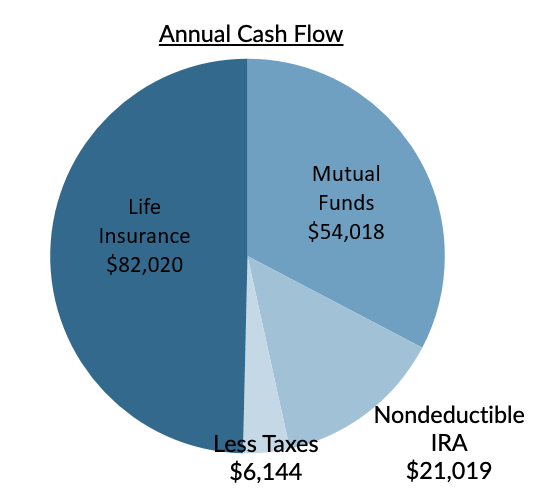

Using nondeductible IRA Mutual Funds and Life Insurance

Annual cash flow after taxes $514,713

Here are the results for Susan

| Taxes | Net Cash Flow | |

|---|---|---|

| Nondeductible IRA and Taxable ONLY | $10,419 | $116,822 |

| Nondeductible IRA, Taxable and Life Insurance | $6,144 | $150,913 |

Death Benefit → $122,919*

Added Cash Flow → $34,091

An example is hypothetical and for illustrative purposes.

*Death benefit will decrease over time (e.g. approx. $73,000 at Age 95; $10,000 at Age 100) but invoking the Overloan Protection riders will guarantee the policies will not lapse

If you Like What You See or Would like to Learn More Click Contact Us Below

Contact Us